If that’s true, then you should know about all of its features, like PayPal Credit (formerly Bill Me Later), and the ability to accept money in person (and using Bitcoin). If not, then it’s time you learn all about what PayPal for business has to offer. First, let’s take a look at PayPal Credit.

What Is PayPal Credit?

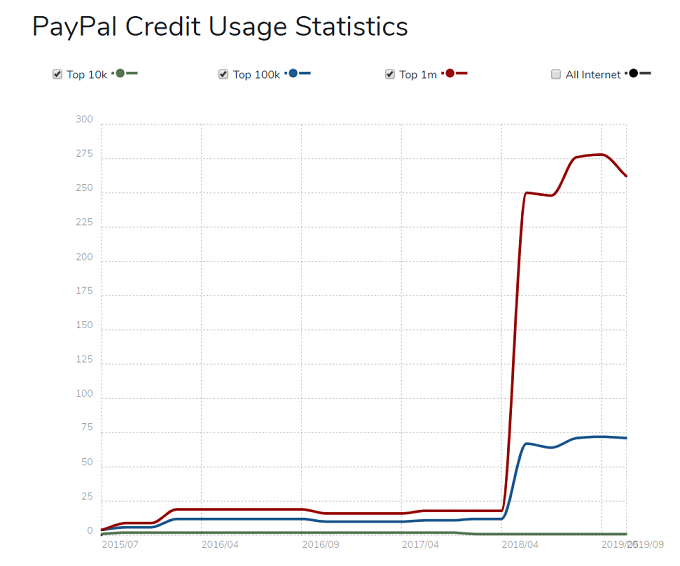

PayPal Credit, formerly known as Bill Me Later, has been around since 2008. It allows merchants to offer credit to customers so they can buy now and pay later (only for orders $99 or more). It sounds counterproductive for an e-commerce store, but it’s, in fact, ingenious. Although your customers don’t pay upfront, you still get paid right away. There’s no disruption from your existing PayPal checkout flow. Then the customer has six months to pay off the balance in full. Surprisingly, PayPal Credit usage didn’t take off right away. It was stagnant at around 25 million users until 2018 and 2019 when it soared from 250 million to 275 million. Then at the beginning of 2019, it reached $50 billion in transaction volume. Ryan will shortly be bringing out a more in-depth article on Paypal credit and how it works exactly.

How To Add a PayPal Credit Banner To Your Shopify Cart

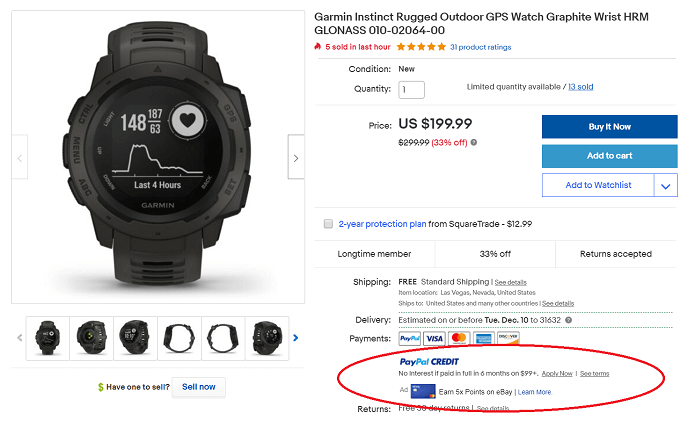

When you use PayPal for business, it’s good to promote that you’re accepting PayPal Credit payments in your ecommerce store for orders over $99. This way, you can entice visitors to add enough items in their cart to qualify. Those who don’t have PayPal Credit will be able to apply. Here’s how to add a banner to your product page on your Shopify cart:

How To Add a PayPal Credit Button To Your Magento Store

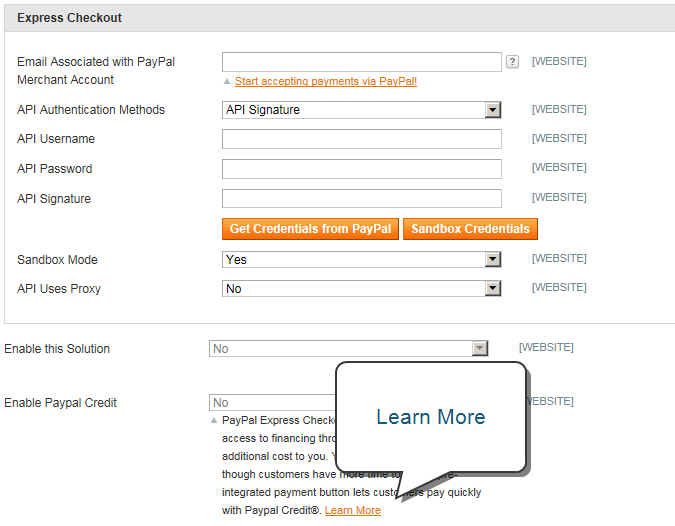

It doesn’t cost you a dime to offer finance to customers through PayPal Credit. Here’s how you can set it up in Magento. Now your customers are ready to make purchases from your Magento store using PayPal Credit.

5 Other PayPal Features For Your Business Should Try

Many businesses use PayPal for years without taking advantage of any of its additional features. This is partly due to them not doing any research or simply clicking around the platform to learn more about what it has to offer. So we’re going to take a look at five features PayPal offers for businesses that you should consider using.

Make Mass Payments

If you’re in a business that uses contractors, freelancers, or remote employees, then you likely submit payments virtually. Rather than doing it one at a time, you can use PayPal’s mass payments feature. This is ideal if you have more than a handful of payments to make each month. With this feature, you can take care of all payments in one go. Then if it’s the same amount each month, you can save the template, so you don’t have to fill out emails each time.

Accept Bitcoin With Braintree

PayPal owns Braintree, which is an online payment solution that accepts all sorts of payment types – including Bitcoin. If you’re on the cryptocurrency bandwagon, then this is the perfect way to get your foot in the door (and Bitcoin in your virtual wallet).

Get Your Programmers to Tweak PayPal’s Open Source Code

Open source software far exceeds its closed source counterparts because it continues to grow at a rapid rate. When you open the door for programmers across the world to work on your SDK, then you’re bound to see evolution occur time and time again. This is one reason PayPal remains a leader in payment solutions. Now that you know the platform is open source, why not see how you can add to the code to make it even better? There are currently several active projects, including a credit card scanner for mobile apps and a real-time metadata scanner.

Accept In-Person Payments With a Card Reader

Maybe your business isn’t entirely online. If that’s the case, then you’ll need a way to offer flexible billing for your in-person transactions. Rather than only accepting cash and checks, you can expand to credit and debit cards using a POS (point of sale) system. You can plug this into your smartphone or tablet to swipe cards. The updated systems also come with card readers. Everything’s done through the app for your convenience.

Expand Your Business With Working Capital Loans

Here’s something you don’t see every day with payment processors. In the past, you had to rely on investors and banks to get funding to grow your business. Today, you can use your PayPal account to apply for working capital loans (all without it affecting your credit score). You can apply and receive funding to your account within minutes (no credit check required). The amount you qualify for will depend on your annual sales. You have to make at least $15,000 per year in sales and have had a business account for at least three months. PayPal will offer up to 35% of your sales. You’ll get several options for repayment – you can opt to have PayPal take between 10% and 35% off your sales until the loan is paid off. There are set fees, which are determined by the percentage you choose for the payoff. You can play around with different amounts (up to the maximum it offers) to see what works for your budget. The minimum you can take out is $1,500. Once you repay the loan (yes, you can pay it off early without penalty), you can apply for another after three days.

Maximize Your Sales With PayPal’s Features

PayPal is more than just a payment processor, it’s a business partner. When used to its full potential, you can grow your sales and get backing to fund your expansion. If you’re serious about your online (or offline) business, then we recommend giving these PayPal business features a try.